Knowing where you are financially with the intention of improving things is a good thing to do. Money is of importance even though the Bible warns against loving it. It also warns against lusting after wealth. Note that the Bible is not saying money and wealth are wrong. But we should be careful that God is always number one in our lives compared to all worldly wealth. We shall assess ourselves regarding our finances. This will cover debt, saving, starting a business, and investing. These things are imperative if we are to live the life we desire and please God at the same time. Today we will take our reading from two portions of scripture:

Knowing where you are financially with the intention of improving things is a good thing to do. Money is of importance even though the Bible warns against loving it. It also warns against lusting after wealth. Note that the Bible is not saying money and wealth are wrong. But we should be careful that God is always number one in our lives compared to all worldly wealth. We shall assess ourselves regarding our finances. This will cover debt, saving, starting a business, and investing. These things are imperative if we are to live the life we desire and please God at the same time. Today we will take our reading from two portions of scripture:

“Those who love money will never be satisfied with the money they have. Those who love wealth will not be satisfied when they get more and more. This is also senseless.”(Eccl. 5:10)

“But remember that it is the LORD your God who gives you the power to gain wealth, in order to confirm His covenant that He swore to your fathers even to this day.” (Deut. 8:18).

Always ensure that God is number one in your life. He should not be replaced by money and wealth. Otherwise, you will be lost. We agree that money is key to successful living. That glorifies God.

Here are some of the issues or concerns to consider when assessing yourself:

1) Can you stay on top of your debt?

Debt helps one buy assets that cannot be bought with cash. This is because they are expensive and it takes a long time to accumulate enough cash. However, debt can also delay life progress as it takes more money than borrowed to repay it. So, the question is: can you repay the loan comfortably, while meeting other financial obligations? If it is difficult, try and negotiate with your lender to see how you can best handle the challenge.

On the other hand, some people may argue that debt is not always a bad thing. While it is true that debt can delay life progress, debt can also help one buy assets that they may not be able to buy with cash. For example, a house or a car. In addition, debt can also help one start a business or go to college.

In his book, Rich Dad Poor Dad, Robert Kiyosaki (Kiyosaki, 2000) says, “The rich use debt to get richer, while the poor use debt to get poorer.” Debt can be a tool to create wealth and build a better future.

2) Can you save?

Since you have a debt to repay (or with no debt), can you put money aside for the future? Everyone should strive to save for the future regardless of their current financial situation. Even if it’s just a small amount, putting away some money each month can help you reach your long-term financial goals. It is advisable to start saving without waiting to experience the need for such. At least 10% of your income is recommended if possible.

However, there are individuals who may not be able to save 10% of their income. Some may live paycheck to paycheck due to high living expenses or other debts. For these individuals, it may be more difficult to save, but it is still possible to start small and gradually increase the amount they put away each month. Even for those individuals, establishing healthy money habits can still help build a solid financial foundation. Even small amounts of savings can add up over time and create a cushion for unexpected expenses or goals.

A quote from George Classon on the Richest Man in Babylon on saving says, “Save a part of your income and begin now, for the man with a surplus controls circumstances and the man without a surplus is controlled by circumstances” (Classon, 2019).

3) Do you own a business for additional income?

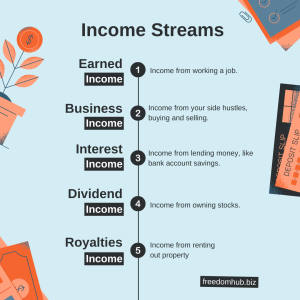

It is common for people to say that the money they earn is not enough to meet their needs. Therefore, they need to supplement their income. Starting a business can be a great way to do this. It can provide additional financial security, as well as the potential for growth and development. Furthermore, it can give a sense of pride and accomplishment. There are many ways to supplement one’s income, but some of the most common include becoming a landlord, writing a book, selling a product, offering rides, shopping for others, completing tasks, hosting seminars, and making a hobby into a job (Indeed, 2023).

However, starting a business also has its risks. It can be difficult to get started, and many businesses fail within the first year. There is also the potential for financial loss, and the stress of running a business can take a toll on one’s personal life. Therefore, it is essential to take the time to evaluate the risks associated with starting a business before jumping in headfirst.

4) Do you invest?

As part of assessing your financial situation, remind yourself if you have any investment. Of course, the ideal situation would be to first save, then invest the savings to make more money. Before investing, make sure to understand the risks involved and the types of investments available. Research the market and the different investment options to find what works best for you. Lastly, plan your investments for the long-term and monitor them regularly.

On the other hand, there are also a few reasons why you shouldn’t invest. One reason is that it ties up your money, making it difficult to access in case of an emergency. Another reason is that there’s always the potential to lose money when you invest, so you need to be comfortable with that risk. Lastly, investing takes time and effort to research and monitor, so it’s not right for everyone. To ensure that investing is the right choice for you, take the time to consider all aspects of the decision, including your available resources, desired outcomes, and risk tolerance.

May I conclude by saying we looked at four questions that need to be answered to assess ourselves financially. Responding to the questions will give you some insight into what to do in your life regarding your financial situation. You should be careful how you use debt. Ensure you save monthly or regularly. Start a side hustle to supplement your income. Last but not least, invest your savings where you are comfortable taking risks.